- Compare medicare advantage plans and medigap plans full#

- Compare medicare advantage plans and medigap plans plus#

Only a small share of Medigap policyholders (2%) were under age 65 and qualified for Medicare due to having a long-term disability most states do not require insurers to issue Medigap policies to beneficiaries under age 65. Estimated average monthly premiums for Medigap policies range from $150 to around $200.Ĭompared to all traditional Medicare beneficiaries in 2018, a larger share of Medigap policyholders had annual incomes greater than $40,000, had higher education levels, were disproportionately White, and were in excellent, very good, or good health ( Table 1). While Medigap limits the financial exposure of Medicare beneficiaries and provides protection against catastrophic expenses for services covered under Parts A and B, Medigap premiums can be costly and can rise with age, depending on the state in which they are regulated.

Compare medicare advantage plans and medigap plans full#

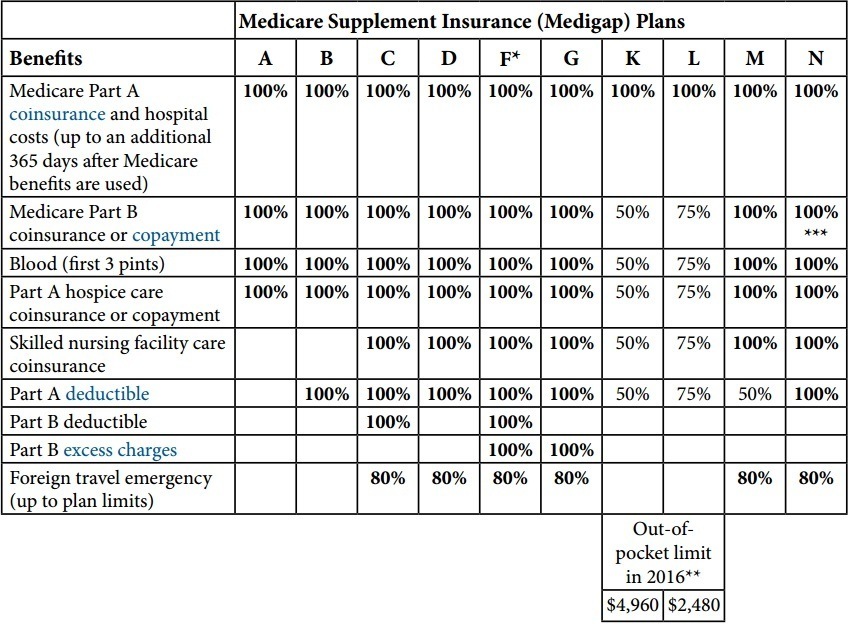

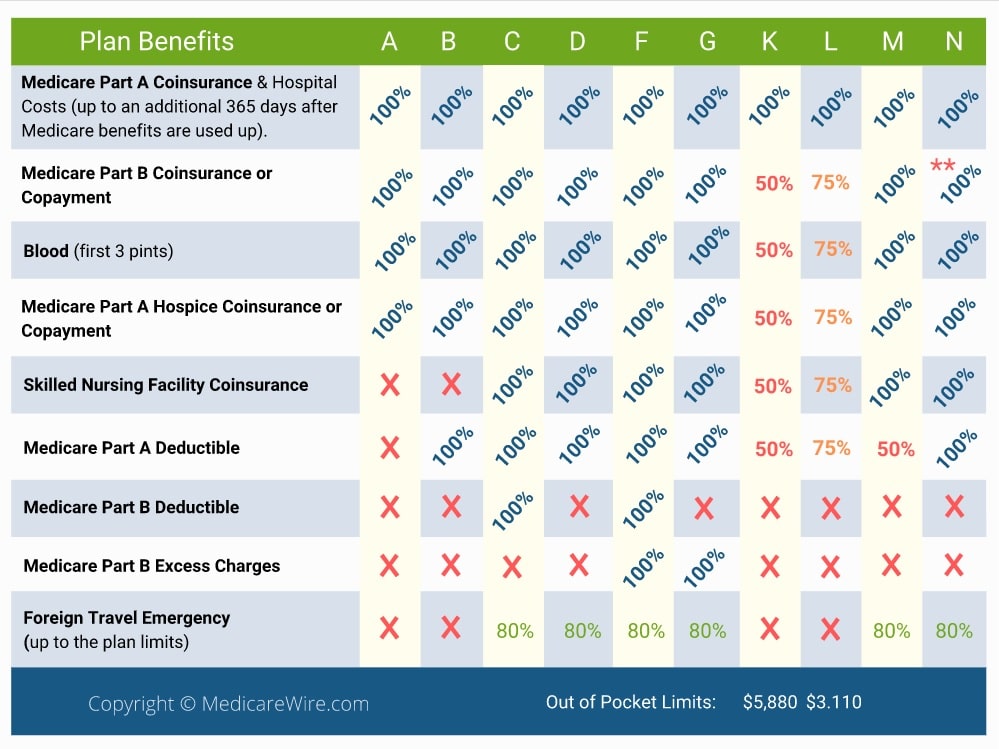

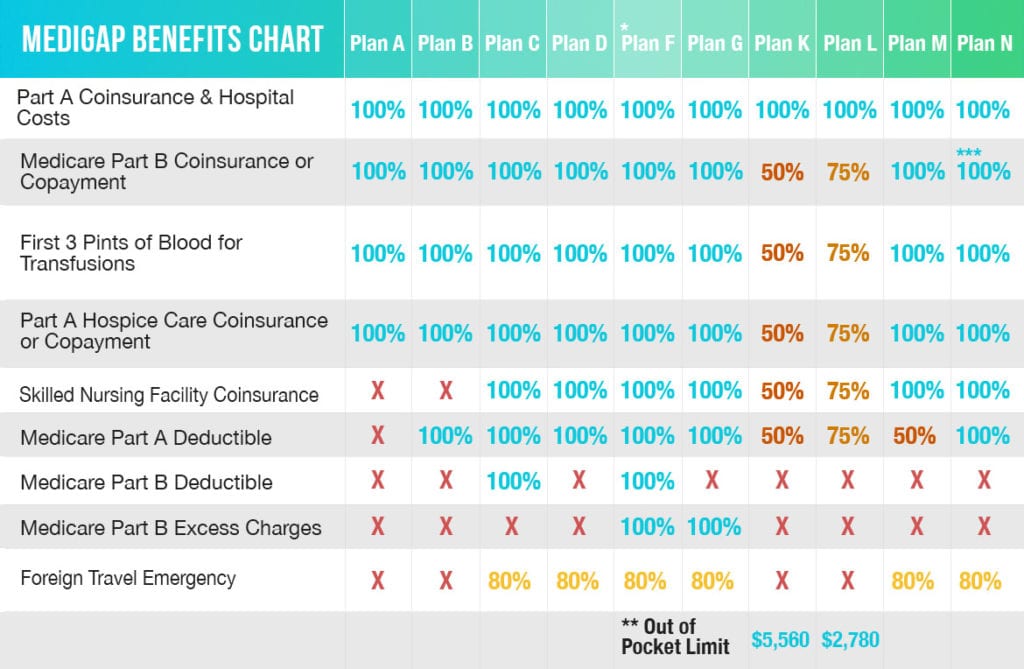

As of January 1, 2020, Medigap policies are prohibited from covering the full Medicare Part B deductible for newly-eligible enrollees however, older beneficiaries who are already enrolled are permitted to keep this coverage. Medigap policies, sold by private insurance companies, fully or partially cover Part A and Part B cost-sharing requirements, including deductibles, copayments, and coinsurance. As with other forms of supplemental insurance, the share of beneficiaries with Medigap varies by state. Medicare supplement insurance, also known as Medigap, provided supplemental coverage to 2 in 10 (21%) Medicare beneficiaries overall, or 34% of those in traditional Medicare (roughly 11 million beneficiaries) in 2018.

Compare medicare advantage plans and medigap plans plus#

Under traditional Medicare, beneficiaries without supplemental coverage in 2021 would pay a deductible of $1,484 for an inpatient hospitalization plus daily copayments for extended hospital and skilled nursing facility stays, and a separate deductible of $203 plus 20% coinsurance for most physician and other outpatient services, including for drugs administered by physicians for cancer and other serious medical conditions.įigure 2: Nearly One in Five Traditional Medicare Beneficiaries Had No Source of Supplemental Coverage in 2018 Medigap But 1 in 10 Medicare beneficiaries (10%) – 5.6 million people – were covered under traditional Medicare with no supplemental coverage, which places them at greater risk of incurring high medical expenses or foregoing medical care due to costs. Nine in 10 people with Medicare either had traditional Medicare along with some type of supplemental coverage (51%), including Medigap, employer-sponsored insurance, and Medicaid, or were enrolled in Medicare Advantage (39%) in 2018 (Figure 1). All differences reported in the text are statistically significant ( see Methods for additional details).

The analysis also focuses only on coverage for Part A and Part B benefits, not Part D. The analysis excludes Medicare beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2018 (4.7 million people) and beneficiaries who had Medicare as a secondary payer to employer or other coverage (1.7 million people).

This data note explores sources of coverage among beneficiaries in Medicare and the demographic characteristics of people with different types of coverage, based on data from the 2018 Medicare Current Beneficiary Survey (the most recent year available). Beneficiaries can also enroll in a Part D plan for prescription drug coverage, either a stand-alone plan to supplement traditional Medicare or a Medicare Advantage plan that covers drugs. Supplemental insurance coverage typically covers some or all of Medicare Part A and Part B cost-sharing requirements and, in some instances, provides benefits not otherwise covered by Medicare. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits. Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Medicare beneficiaries can choose to get their Medicare benefits (Part A and Part B) through the traditional Medicare program, or they can enroll in a Medicare Advantage plan, such as a Medicare HMO or PPO. More than 62 million people, including 54 million older adults and 8 million younger adults with disabilities, rely on Medicare for their health insurance coverage.

0 kommentar(er)

0 kommentar(er)